The Purpose of Alberta’s Orphan Program

Alberta’s oil and gas orphan program was created to protect taxpayers from paying for closure costs (the costs associated with abandonment, remediation, and reclamation) by keeping those costs within the conventional oil and gas industry, even where a particular company becomes insolvent or fails to pay for closure.

The orphan program is the product of lengthy negotiations that occurred between 1991 and 2002 between companies in Alberta’s oil and gas industry and Alberta’s oil and gas regulator.1 The regulator agreed to adopt low financial security requirements and relaxed rules for license transfers, and in exchange the oil and gas industry agreed to pay for the closure of the orphans that would result from the relaxed approach to license transfers and financial security.

The Alberta Energy Regulator2 (AER) is supposed to prescribe an annual levy to oil and gas companies that is sufficient to protect the public, and the Orphan Well Association (OWA) is required to provide information on OWA operations to the AER for this purpose.3 To prevent the OWA from accumulating a backlog of unreclaimed orphan sites, the AER should ordinarily set its annual levies to cover the cost of existing OWA inventory as well as the anticipated closure costs for orphan sites expected to be transferred to the OWA in the coming year, but the AER has failed to do so.

In March 2023, Alberta’s Auditor General reported that the AER has not been monitoring or assessing its orphan fund levy, writing:

Before 2022, AER did not scrutinize the orphan levy proposed by OWA and did not analyze longer-term sustainability of the Orphan Fund… There were no examples of AER suggesting modifications to the amount or evidence of AER doing an analysis of the proposed levy.4

The failure of the AER to adequately supervise the orphan program is a central reason for Alberta’s massive orphan liability crisis and the backlog of unreclaimed orphan sites currently on the books at the OWA.

History of Alberta’s Orphan Program

Alberta’s orphan program began in 1994 with a different funding structure managed within the energy regulator.5 The current form of the orphan program started in 2002, which uses an annual orphan fund levy collected from industry. The fund is controlled by the industry-run Orphan Well Association (OWA)6 with delegated authority from the regulator.

From 2003 to 2012, the annual orphan fund levy was consistently set too low, at an average of $12.67 million. In 2009, the Alberta government gave the OWA a $30 million grant as a stimulus grant.7 At the end of 2012, after the entire $30 million grant had been spent, the OWA had closed a complete total of 421 sites and had 389 sites left in their inventory.8

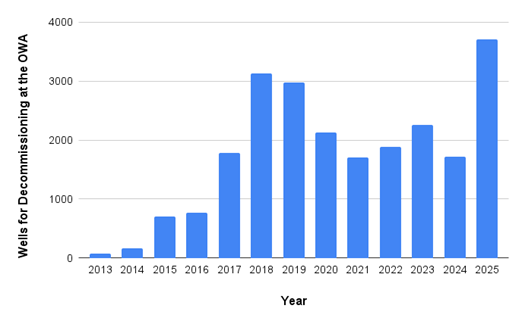

Beginning in 2013, an increasing number of oil and gas industry bankruptcies accelerated the growth of the backlog of orphan sites managed by the OWA (Figure 1). There has recently been another significant rise in the number of orphan wells due to the Sequoia Resources Corporation bankruptcy settlement, which included a $30 million payment to the OWA to partially cover closure costs for sites transferred to the OWA.9

The number of orphan well sites requiring reclamation (Figure 1) is only part of the story. Pipelines, and oil and gas facilities all require decommissioning or reclamation, adding to the growing orphan inventory.

Figure 1. Number of Orphan Wells for Decommissioning with the Orphan Well Association

Source: OWA annual reports: 2012/13–2023/24, the 2025 number is from the OWA’s website inventory report, accessed 4 May 2025

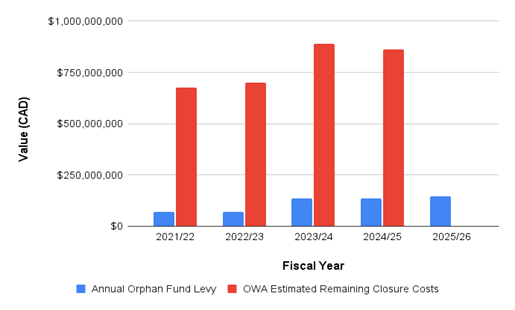

Figure 2. The AER’s Annual Orphan Fund Levy Compared Against the OWA’s Estimated Total Remaining Closure Costs

Source: Orphan Well Association Annual Reports, 2021/22 to 2023/24.

Government Loans

The OWA also holds interest-free loans from the provincial and federal governments currently exceeding $337 million, with a planned repayment schedule extending to 2035 that has the largest payments scheduled for 2032 to 2035.

The OWA’s loan repayment schedule for each year is as follows:

| Year | Amount ($) | Level of Government | Loan Remaining ($) |

|---|---|---|---|

| 2025 | 30,198,413.00 | Provincial Loan 1 | 361,151,726.25 |

| 2026 | 30,198,413.00 | Provincial Loan 1 | 330,953,313.25 |

| 2027 | 7,549,600.25 | Provincial Loan 1 | 300,754,900.25 |

| 2028 | 25,000,000.00 | Provincial Loan 2 | 300,000,000.00 |

| 2029 | 25,000,000.00 | Provincial Loan 2 | 275,000,000.00 |

| 2030 | 25,000,000.00 | Provincial Loan 2 | 250,000,000.00 |

| 2031 | 25,000,000.00 | Provincial Loan 2 | 225,000,000.00 |

| 2032 | 50,000,000.00 | Federal Loan | 200,000,000.00 |

| 2033 | 50,000,000.00 | Federal Loan | 150,000,000.00 |

| 2034 | 50,000,000.00 | Federal Loan | 100,000,000.00 |

| 2035 | 50,000,000.00 | Federal Loan | 50,000,000.00 |

Source: Orphan Well Association 2023/2024 Annual Report at 35.

Note that specific payments are scheduled quarterly rather than yearly.

The OWA should also be planning to receive more orphan assets in coming years. According to the AER’s 2024 Liability Management Performance Report10, as of October 2024, there are another 100 licensees in the conventional oil and gas industry the AER has identified as being in “high financial distress.” Those 100 licensees hold $2.38 billion in closure liabilities, a significant share of which is likely to be transferred to the OWA in the coming years as those licensees enter insolvency processes.

Addressing the $1.2 Billion Shortfall

Today, the OWA is $862 million behind where they ought to be in spending on orphan closure11, and has $337 million in government loan repayment obligations extending to 2035. This means the past orphan fund levies have been collectively too low by $1.2 billion.

This problem is the direct result of the industry-controlled OWA proposing successive, unreasonably low orphan levies, and the regulator failing to scrutinize these levies until 2022.

The AER is now responsible for prescribing an annual levy to industry at an amount that will correct for their ongoing failure.

On March 31, 2025, the AER prescribed an orphan fund levy of $144.45 million for the 2025/2026 fiscal year.12 This amount represents just 12% of the $1.2 billion in closure liabilities and loans currently held by the OWA.

The AER bulletin prescribing the 2025/2026 orphan fund levy includes no reasons or justifications. It provides no explanation for how the AER determined a $144.45 million orphan fund levy was sufficient to ensure the sustainability of the orphan fund. The Bulletin says that the Government of Alberta approved the 2025/2026 orphan fund levy, despite the Government of Alberta having no role in setting or approving the orphan fund levy under section 73 of the Oil and Gas Conservation Act.

The 2025/2026 orphan fund levy was set without any hearing, consultation, or opportunity for submissions from landowners, municipalities or taxpayers whose interests are impacted by the amount of the orphan fund levy. A decision that has been consistently made wrong in the past was again made without any procedural fairness: no advance notice, no hearings, and no reasons provided for the decision.

- Drew Yewchuk, Shaun Fluker, Martin Olszynski, “A Made-in-Alberta Failure: Unfunded Oil and Gas Closure Liability” (2023) 16:31 University of Calgary School of Public Policy Research Paper, online: https://doi.org/10.11575/sppp.v16i1.77468 at pages 14-15. Partial records of the negotiations are attached to that paper as appendices D-J. ↩︎

- Alberta’s oil and gas regulator has been the AER since it was established by the Responsible Energy Development Act, SA 2012, c R-17.3. Prior to the AER’s creation, the Energy Resources Conservation Board and the Energy and Utilities Board had been responsible for the orphan fund. ↩︎

- Orphan Fund Delegated Administration Regulation, Alta Reg 45/2001 section 6. ↩︎

- Auditor General of Alberta, Liability Management of (Non-Oil Sands) Oil and Gas Infrastructure Alberta Energy Regulator, March 2023 https://www.oag.ab.ca/wp-content/uploads/2023/03/Liability-management-oil-gas-mar2023.pdf at page 26, see general pages 24-27. ↩︎

- The regulator at the time was the Alberta Energy and Utilities Board (the EUB). ↩︎

- The full name is the Alberta Oil and Gas Orphan Abandonment and Reclamation Association. See the Orphan Fund Delegated Administration Regulation at s.1(1)(b) and (2). ↩︎

- Orphan Well Association 2011/12 Annual Report, at page 5. ↩︎

- Orphan Well Association 2011/12 Annual Report, at page 9. ↩︎

- Kyle Bakx, “Number of orphan wells in Alberta will soon double as controversial oilpatch bankruptcy settled” (1 October 2024) CBC News, online: https://www.cbc.ca/news/canada/calgary/bakx-owa-seqouia-pwc-alberta-orphan-wells-1.7336635 ↩︎

- AER, online: https://www.aer.ca/data-and-performance-reports/industry-performance/liability-management-performance-report/estimated-liability-and-licensee-capability ↩︎

- As of March 31, 2024, see Orphan Well Association 2023/24 Annual Report, at page 5. More orphan assets have moved to the OWA from the Sequoia bankruptcy process since March 2024. ↩︎

- AER Bulletin 2025-13, 2025/26 Orphan Fund Levy, 31 March 2025. ↩︎